Islamabad (Muhammad Yasir) Pakistan Poverty Alleviation Fund (PPAF) has won the prestigious CIS Islamic Banking and Finance for being the best contributor to the Islamic Finance Industry in a ceremony held recently in Tashkent, Uzbekistan. PPAF was selected for successfully implementing the Interest Free Loan Program across Pakistan. The CIS Islamic Banking and Finance Awards is a signature initiative of AlHuda CIBE aimed to recognize the industry leaders and to promote the concept of sustainable economy. The Awards were presented in 15 categories to international Islamic microfinance institutions, takaful and leasing companies, banks, and individuals for their outstanding services to the Islamic Microfinance Industry.

PPAF’s Interest Free Loan Program was selected for its extensive outreach and its unique feature of catering to the financial needs of the poor and marginalized communities across Pakistan with women being the major clients. The design of the loan program offers acceptability under Islamic Microfinance in areas where religious sentiments are high and conventional microfinance is not welcomed. The loans besides being interest free do not carry any additional charge/ fee i.e. documentation, processing, voluntary, insurance etc. As part of the program, trainings are organized for the loan recipients for optimum utilization of loans for expansion of their businesses. The Interest Free Loan (IFL) Programme of PPAF is part of Government of Pakistan’s programme “Ehsaas”, a flagship initiative for poverty alleviation working under the ambit of ‘Poverty Alleviation and Social Safety Division’.

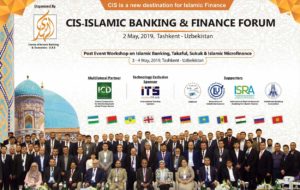

Dr. Irfan Yusuf Shami, Ambassador of the Islamic Republic of Pakistan to Uzbekistan, as the Chief Guest, inaugurated the forum. He spoke of Islamic finance being the need of the time and Central Asia’s need to observe the potential of Islamic banking and finance and the value it can bring to international banking and finance. The ambassador said that investing in Islamic banking and finance will lead to greater foreign investments, promising enhanced global connectivity, improved job creation, socio-economic development, and poverty alleviation. This transcending Islamic financial sector may also create genuine global opportunities for Uzbekistan. Dr. Shami also said that he vigorously endorsed Pakistan’s ambassadorial role in promoting meaningful contributions to the advancement of Islamic finance at all levels, paving the way towards a better community and making a difference in the world.

While receiving the Award, Mr. Farid Sabir, General Manager, Interest Free Loan Program, PPAF shared that as of April 2019, PPAF has provided 524,470 Interest Free Loans to the needful, 67% being women clients, the said that PPAF is implementing the IFL through its 26 partner organizations in 442 Union Councils of 45 districts of Pakistan as such an amount of Rs. 12.9 billion has been disbursed with the average loan size of Rs. 24, 596. The Program has benefitted more than half a million directly while 3 million people are benefited indirectly from IFL program. He also said that the Interest Free Loan Program is a tool of financial inclusion and poverty alleviation for the poor and is an integral part of the graduation approach of PPAF.

Distinguished speakers and industry experts from notable organizations working in Islamic banking and finance, Islamic insurance, and the banking industry also participated in the event. Commonwealth of Independent States (CIS) is a regional intergovernmental organization of 11 countries which include Kazakhstan, Uzbekistan, Tajikistan, Kyrgyzstan, Turkmenistan, Azerbaijan, Russia, Armenia, Belarus, Moldova, and Ukraine. The forum, where the awards were presented, was set up to promote, strengthen, and unite the Islamic banking and finance industry of CIS countries under the theme of “CIS as new destination for Islamic Finance.”

Financial inclusion, fintech, sukuk, takaful, Islamic capital markets, Islamic microfinance, potential and opportunities of Islamic finance in CIS countries were also discussed by the forum. The forum was organized by the Al-Huda Centre of Islamic Banking and Economics (UAE) in partnership with Islamic Corporation for Development of Private Sector (ICD), Islamic Development Bank (IsDB) and Uzbekistan Bank Association.