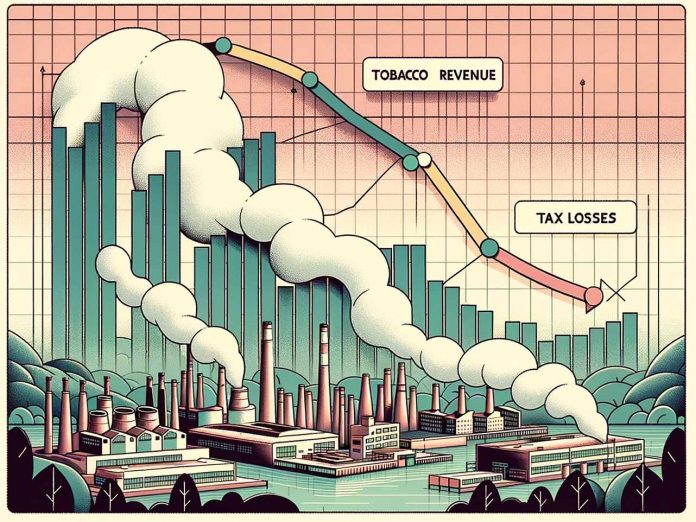

The latest data from Pakistan Tobacco Company Limited (PTC) paints a worrying picture of a tobacco sector in chaos. Since the Federal Excise Duty (FED) on tobacco products skyrocketed by a staggering 200% in FY 22/23, the illicit tobacco market has surged, constituting a concerning 63% of the total volume of cigarettes in circulation. This means that for every legitimate packet of cigarettes sold, almost two illicit ones find their way into the hands of consumers. And the repercussions? A loss to the government coffers that could very well eclipse the total revenue generated from the legitimate industry in FY23/24.

According to Qasim Tariq, Senior Business Development Manager for PTC, this potential government revenue shortfall could be in the ballpark of USD 1 billion or an overwhelming 300 billion Rupees. The illicit market’s meteoric rise isn’t just a cause for concern for the government but also casts shadows over the survival of the legitimate tobacco sector. PTC’s shipment data from FY21/22 starkly shows a reduction of more than 55% in legitimate sector volumes from January to June 2023. This downtrend is a clear indicator of the changing consumer behaviour— a shift from legal to tax-evaded and smuggled cigarettes, with an anticipated volume loss of more than 11 billion cigarettes. Recent media reports, although painting a rosy picture of revenue collections from the tobacco industry, don’t tell the full story. Tariq asserts that the on-ground realities need consideration when framing a holistic policy. “Increasing tax rates on cigarettes doesn’t even faze the illicit sector, which doesn’t come under the tax net to begin with,” Tariq noted. And what about increased excise rates on imported cigarettes? Tariq dismisses the potential impact, pointing out that the majority of foreign cigarette brands find their way into the country through illegal channels. He also mentioned the seemingly doomed fate of the much-discussed digitized stamp system, given the lackluster implementation of the existing track and trace system. So, what’s the solution? Tariq believes that the panacea lies in a balanced approach. It’s about blending appropriate fiscal policies with robust and unbiased enforcement.

The surge in illicit trade is not just a threat to the national exchequer but also speaks of a larger issue where evasion and illegitimacy might become the norm. It’s high time Pakistan finds that balance before the scales tip too far.