Lahore (NUT-Technology)

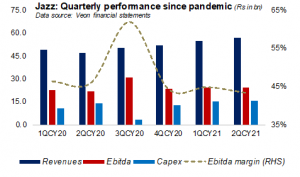

Pakistan’s leading mobile network operator (MNO) has had yet another strong quarter. Topline at Pakistan Mobile Communications Limited (‘Jazz’) increased by 21 percent year-on-year to cross Rs57 billion in the quarter ended June 30, 2021, as per latest financial results posted by its parent Veon earlier this week. Ebitda grew by 14.5 percent year-on-year in 2QCY21 to reach Rs25 billion, yielding a 43 percent margin. Size and strategy seem to be keeping Jazz in a well-assured position of market leader.

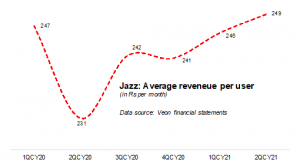

The pace of yearly growth in operating revenues last quarter was the highest than in any quarter since 1QCY19. The key indicator – Average Revenue per User (ARPU) – has perked up to Rs249 per month in the latest quarter, growing by 8 percent over the ARPU during 2QCY20. Both the core mobile services and data revenues have shown handsome growth, with the data business especially prominent. However, ARPU has some way to climb before catching up with the recent peak of Rs272 per month (1QCY19).

Buoyed by strong growth in data subscriptions as well as higher data usage, data revenues at Jazz reached almost Rs21 billion in 2QCY21, showing a 31 percent yearly growth and accounting for 37 percent of overall operating revenues. As of June end, there were over 48 million data customers with Jazz, which is an 18 percent expansion compared to June 2020. Overall ARPU is improving in tandem. Data growth has come in the midst of an active pandemic, as more and more people find it essential to use digital means for the purpose of work, commerce, social interactions, education and remote health. Within the Jazz data user base, the number of 4G users stood at nearly 31 million as of June 2021, recording a massive jump of 61 percent since June 2020.

The corporate strategy is to improve concentration of 4G users in the subscription pie, as data services stand a much more favorable chance of monetization compared to voice and text services. Investments are being made accordingly, as the MNO spent roughly Rs16 billion on capital expenditure during the quarter (10% YoY growth), mainly to expand 4G networks. It is financing its capital expenditures mainly from local credit facilities.

The investment shows in growing 4G coverage, which has increased for Jazz from 56 percent of population area in June last year to 64 percent in June 2021. The “scale” that Jazz has amassed over the years after acquiring Warid and expanding its data networks allows it to better manage the headwinds of low revenue growth and rising operating expenditures that are proving challenging for other operators.

At the close of half-year, Jazz is on a strong footing. Revenues have grown by 16.5 percent to Rs112 billion in 1HCY21, with strong growth in data revenues and double-digit hike in mobile service revenues as well. Ebitda growth in the period was a bit lower at 11 percent to Rs50 billion, as the MNO is making high marketing investments in its brands, mainly JazzCash, which is showing a significant increase in its monthly active users. Let’s see what kind of firepower Jazz brings to the spectrum auction in a few weeks.